Can You Get Subsidence Repair Loans?

Many homeowners in the UK may experience subsidence on their property. When an issue such as subsidence emerges, we might not always have the funds to manage the problem. This is where subsidence repair loans come in.

It is possible to get a loan to carry out repair work on a property with subsidence. However, not all lenders are willing to lend on a property with subsidence, particularly when the cause is uncertain. Most lenders require a detailed report from a structural engineer. This report must include the cause of the subsidence, the necessary work to fix it, and the associated costs.

Discover how subsidence works, the repair costs associated with subsidence, and how you can get a subsidence repair loan in such circumstances with The Second Mortgage Company.

What Is Subsidence?

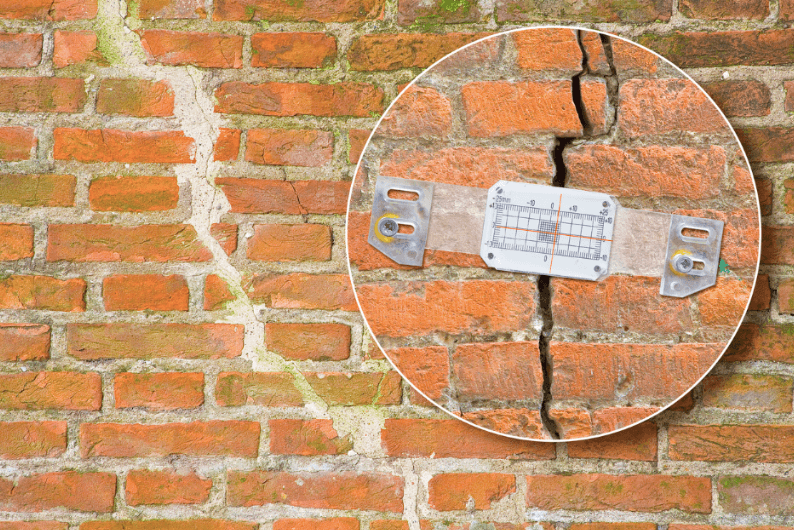

Subsidence is when the ground beneath a house sinks. This can cause cracks in the building, both inside and outside. Uneven floors can also indicate that a property is suffering from subsidence, though generally subsidence is found in older properties. If not addressed, it can make the property structurally unsafe and require evacuation.

There are several causes of property damage, such as:

- Properties built on old mine quarries

- A long-term water leak from a drain, making the soil very wet

- The roots of trees damaging a property's foundations

- Foundation damage due to clay shrinkage

How Is Subsidence Found?

Subsidence can often be seen by the homeowner. One of the most obvious signs is large cracks in the walls of a property. Other signs of subsidence include sinking floors, wallpaper wrinkling, windows and doors sticking and an extension moving away from the main property structure.

If you are uncertain as to whether your property requires attention you should obtain the services of a structural engineer who should be able to advise you of the cause, the action required to remedy the problem and the repair costs.

It may mean monitoring the situation over a period of time to see if there is any further movement.

Subsidence Repair Costs

The cost of repairing subsidence issues varies enormously depending on the cause of the subsidence. If it’s a case of removing a tree root and stump that is causing the problems then the cost could range between £500 - £1000. If however, you had to carry out extensive underpinning to a larger property the cost could be in excess of £50,000.

Overall the average cost to fix a subsidence problem is in the region of £15,000.

When you buy a property you take out buildings and home insurance. Insurance companies will want to know if there has been a history of subsidence. This is in case you make an insurance claim. If you've not made an insurance company aware that there has been historical subsidence, they may decline any claim.

Can I Get A Mortgage On A Property With Subsidence?

Generally, only cash buyers can purchase a house with serious subsidence. It may be possible to obtain a short-term bridging loan. These loans are usually over a 12-month term and can be taken out if you borrow no more than 50% of the property’s value. Interest rates vary with bridging finance but it could easily be 1% per month or more.

The lender will often want to know how you plan to repay the loan - this is called the ‘exit’. Once subsidence repair works have been carried out and the problem rectified, it should then be possible to get a mortgage at normal interest rates.

It is beneficial to finish any repair work as quickly as possible so you can remortgage sooner and avoid paying more than 1% interest per month. So overall, yes you can get a mortgage on a property with subsidence but it is recommended to wait until any repairs have been completed to avoid high interest rates.

Can I Get A Bridging Loan With Bad Credit?

Yes, you can normally take out a bridging loan with bad credit. With a bridging loan, you do not make any monthly repayments. Instead, the interest rolls up monthly until you pay off the loan. The maximum term with a bridging loan is normally 12 months.

Much like a mortgage, the lender will want to know how you intend to pay off the bridging loan. With a bridging loan for subsidence, your exit route is likely to be to sell the property, or remortgage to a traditional mortgage over a longer term, say 25 years. However, you need to be confident that you can get a traditional mortgage with bad credit, because if you can’t the only option may be to sell the property.

It would be advisable to seek the services of an experienced mortgage broker. They will consider your credit history when looking for potential lenders and tell you if you are likely to get a regular mortgage.

Can I Get A Second Mortgage For Subsidence?

When applying for a second-charge mortgage, a lender normally requires your property to be valued by a professional valuer. If it is apparent that there is a potential subsidence problem then the proposed lender may request a full report from a structural engineer to establish the severity of the problem and the likely cost to rectify the issue.

If the problem is easily solved, for example by removing some tree roots, then the lender is likely to grant the second mortgage. If however it is considered to be a major problem and a large cost to put it right, there may be a reluctance for a lender to agree to an application. Each application would therefore be considered on its own merits.

Subsidence and Property Maintenance: Long-Term Solutions for Homeowners

Subsidence can be a concerning issue for homeowners, but there are long-term solutions available for property maintenance that can help mitigate the risks.

One key approach is proactive tree management, including regular inspections and timely removal of trees with invasive roots that can cause subsidence. Maintaining proper drainage around the property, fixing any water leaks, and managing the moisture content of the soil can also help prevent subsidence.

Additionally, investing in proper foundation maintenance and repairs, such as underpinning or strengthening, can provide long-term stability to the property. Seeking professional advice from structural engineers and working with reputable contractors can ensure that the maintenance measures are effective and tailored to the specific needs of the property. By implementing these long-term solutions, homeowners can safeguard their property against subsidence and ensure its stability for years to come.

Risks To DIY Subsidence Repairs

If you are planning to undertake your own DIY subsidence repairs on your property, it is important to understand the risks you may be taking. When it comes to DIYs of any capacity, it is often advised to avoid doing so without the help or assistance of a professional. They may seem cost-effective, but DIY repairs do come with risks and should be approached with caution. Some of the risks of DIY repairs are outlined below to give you a better idea of what you might face.

Lack Of Expertise

Subsidence repair is a complex process that requires specialized knowledge and experience. DIY repairs without proper expertise can lead to inadequate repairs, which may not effectively address the underlying issue and can result in further damage to the structure.

Safety Hazards

Subsidence repair often involves working with heavy machinery, power tools, and hazardous materials. DIY repairs without proper safety measures can pose risks such as injuries from falls, exposure to toxic substances, or structural collapses.

Legal And Insurance Issues

DIY subsidence repairs may not comply with building codes and regulations, which could result in legal and insurance issues. Insurance companies may also require professional repairs to be eligible for coverage, and DIY repairs may void insurance policies.

Does Subsidence Devalue A Property?

Subsidence, which refers to the sinking or settling of the ground beneath a property, can significantly devalue a property. The extent to which subsidence affects property value will depend on various factors, such as the severity and frequency of subsidence events, the location and type of property, and the measures taken to mitigate subsidence risks.

Subsidence issues can be a warning sign for potential buyers and insurers. This can cause a decrease in demand, as well as the value of the property. Plus, the cost of repairing subsidence damage and ongoing monitoring and maintenance can be substantial, further impacting a property's value.

Therefore, subsidence can have a notable negative impact on property value, and it's crucial for property owners to address subsidence issues promptly to minimize the devaluation of their property.

If you require a loan to repair subsidence, or for any other reason, please contact us through our online application.